Personal Loans copyright Fundamentals Explained

Personal Loans copyright Fundamentals Explained

Blog Article

Some Known Questions About Personal Loans copyright.

Table of ContentsSome Ideas on Personal Loans copyright You Need To KnowNot known Facts About Personal Loans copyrightSome Known Details About Personal Loans copyright Personal Loans copyright Can Be Fun For EveryoneThe 45-Second Trick For Personal Loans copyright

Let's study what an individual lending actually is (and what it's not), the reasons individuals use them, and exactly how you can cover those crazy emergency expenses without tackling the burden of debt. A personal funding is a round figure of money you can borrow for. well, almost anything., however that's practically not a personal funding (Personal Loans copyright). Individual car loans are made with a real economic institutionlike a financial institution, credit scores union or online loan provider.

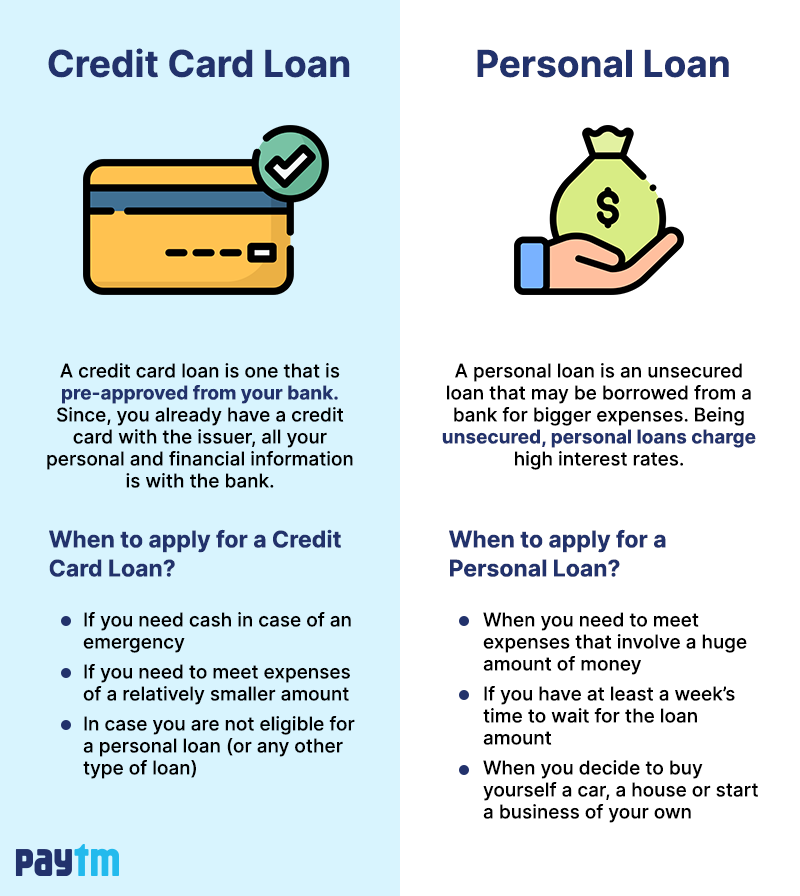

Let's take an appearance at each so you can know precisely just how they workand why you do not require one. Ever. Most individual loans are unsecured, which indicates there's no collateral (something to back the car loan, like a car or house). Unsafe financings usually have higher rate of interest and call for a better credit history since there's no physical thing the lender can eliminate if you do not compensate.

Indicators on Personal Loans copyright You Need To Know

No matter how great your credit report is, you'll still have to pay interest on most individual loans. Protected personal fundings, on the other hand, have some kind of security to "secure" the loan, like a boat, jewelry or RVjust to name a few.

You could additionally take out a safeguarded individual finance using your automobile as security. Depend on us, there's nothing secure concerning safe lendings.

However even if the settlements are predictable, it doesn't suggest this is a great bargain. Like we stated previously, you're pretty a lot assured to pay interest on an individual loan. Simply do the math: You'll wind up paying means a lot more over time by obtaining a loan than if you would certainly simply paid with money

Some Known Details About Personal Loans copyright

And you're the fish holding on a line. An installation finance is an individual funding you repay in taken care of installments gradually (generally as soon as a month) until it's paid in complete - Personal Loans copyright. And don't miss this: You have to pay back the original car loan quantity prior to you can borrow anything else

Do not be mistaken: This isn't the very same as a credit rating card. With individual lines of credit score, you're paying rate of interest on the loaneven if you pay on anchor time.

This one obtains us riled up. Due to the fact that these companies prey on individuals who can't pay their costs. Technically, these are short-term lendings that offer you your paycheck look at this website in development.

Personal Loans copyright - An Overview

Due to the fact that points obtain genuine untidy real fast when you miss a payment. Those financial institutions will certainly come after your sweet grandmother that guaranteed the financing for you. Oh, and you need to never ever cosign a funding for any individual else either!

However all you're really doing is using brand-new financial obligation to settle old debt (and extending your lending term). That simply implies you'll be paying even extra gradually. Business know that toowhich is specifically why a lot of of them offer you combination loans. A lower rate of interest does not obtain you out of debtyou do.

And it begins with not obtaining any type of even more cash. Whether you're believing of taking out an individual car see here now loan to cover that cooking area remodel or your overwhelming credit card expenses. Taking out financial debt to pay for points isn't the method to go.

Facts About Personal Loans copyright Revealed

And if you're taking into consideration an individual finance to cover an emergency situation, we get it. Borrowing money to pay for an emergency just rises the stress and anxiety and challenge of the scenario.

Report this page